….. why What?

Before I tell you what I really want to write about today, here’s some gratuitously beautiful photos of a walk on Hampstead Heath this morning, with my friend Robin. We went to look at Kenwood, gleaming in the sunshine and in its new coats of paint like a piece of cake sugar.

(you might have expected me to approve of that room colour…)

The views from the Heath are amazing. I guess I don’t go up there very often – I’ve never been to Kenwood, in fact. It’s quite a pleasure making new discoveries on a beautiful winter’s day.

Hard to see St. Paul’s these days, tucked in between the forest of cranes that is the London skyline.

But – with the gratuitous shots out of the way, what I really wanted to write about was

THERE’S A REASON WHY… I DON’T OWN A HOUSE.

It’s come up for a specific reason. This week was a big week for us in the office. In the New Year, we’re moving – we’ve finally run out of space at our lovely office on Lambs Conduit Street, which it occurs to me I must write about one of these days. We’ve been very crammed in for ages. And a little while ago, our brilliant landlord, the Rugby School Estate, got in touch (they knew about our space issues) asking if I wanted to have a look at a building that had come free just up the road, tucked down the end of a little hidden alleyway behind the main street.

It’s ideal, and I’m sure in the forthcoming months you might just be reading a bit more about it… here. For now, here’s a sneak preview. Falling to bits, but with incredible potential (and a lot of weird office chairs).

You see what I mean? Fantastic, but it’s going to need a lot of work.

I’m doing a deal with the Estate, where I take on a long lease in return for doing it up right now. The landlords are interested in good long-term tenancies and the terms are incredibly fair to both of us. I get a short but very generous rent free period but I have to fund the work. Now, I won’t go in to facts and details, in order to spare my blushes, but you can imagine that to do this building up is going to take quite a lot of cash. Which, not to spare my blushes, I am afraid I don’t just have sitting under the mattress.

So, what do you do if you need a substantial business loan for a couple of years?

Well, in years gone by, you go to the bank. I bank with one of the big banks, let’s call them Barclays for instance, who a year or two ago nearly went bust for lending a lot of crazy money to a lot of crazy people.

I will not bore you with the details of the conversation, but in a nutshell, my bank won’t lend to me because… I don’t own a house. Why do they want me to own a house? So they could take it if something went wrong with my company repaying its debt. Lovely!

So paranoid are the banks, these days, about lending anyone any money, that the list of questions I needed to satisfy was long as my arm and almost entirely irrelevant to the specifics of my case. I have an aversion to paperwork, it’s true, but when I stared at the list of what I needed to put together… I just gave up.

A few months ago I’d heard an interesting interview, very early in the morning on Radio 4, with the boss of a crowd-funding website called Funding Circle. Check it out here. At the time, I’d thought to myself, perhaps these were the guys for me. And they were.

They have quite stringent requirements to meet, but fundamentally they are asking a question: ‘is this guy good for repaying this loan every month?’. When you’ve been through their scrutiny mill, your loan request is posted on their website. Hundreds and hundreds of investors who want a bit more than they can earn in the bank then lend small amounts of money to lots of small and medium sized businesses. So my request was fulfilled, in a great part, by people lending me £20 or £40 or £160 for a rate of return of about 8%. Within two hours of posting my loan request was fully-funded. Over the next few days the interest rate dropped as new investors underbid the earliest rates. And at the end of the week, the papers were signed and the deal was done.

You’ve got to be pretty worried if you’re one of the big banks. This sort of business really is the genius of the internet.

But. I’m still not writing yet about the case in point, am I?

One of the niggling things that have come up time and again, both with the bank and with Funding Circle, is the question ‘but why don’t you own a house?‘.

They simply cannot comprehend that a successful(ish) young(ish) guy wouldn’t have got my foot on “the ladder”.

I’ve got to admit, it’s a question that comes up quite a lot in a dinner party talk these days as well.

So I thought I’d write some thoughts. And if you ever ask me again, you’ll just find me smiling sweetly, and being directed to a blog I wrote back in December 2013, called… ‘There’s a reason why…’

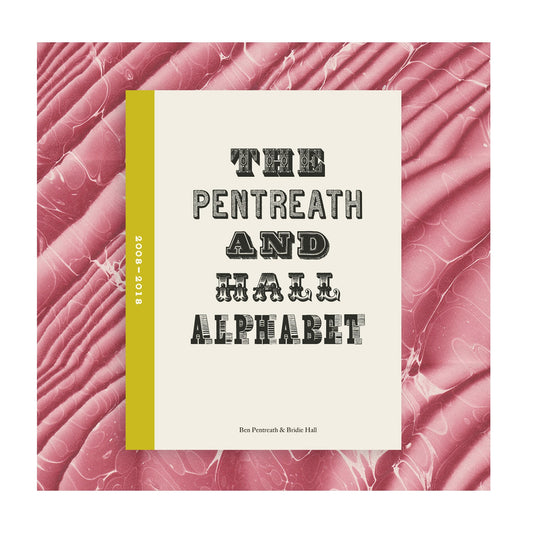

First of, let’s face it, I’m not very good at saving for deposits. I’d rather own five Coronation mugs by Eric Ravilious. In fact, I hate the idea of not doing this or that because I’m saving up for a rainy day. (I’ve never quite understood saving for rainy days in the first place. When it rains I like staying in. The only reason to save is for a sunny day).

Second, I hate being in debt.

Third, I’ve always been a bit terrified by the cost of a mortgage. Let’s just say this. If I wanted to buy a flat for £300,000, which as we all know these days in London would buy you a lovely studio box in Zone 3, and let’s just assume that I wanted to borrow, say, £240,000 from the bank, having saved up £60,000 of my own cash as a deposit (which would take rather a long time)…

… Well, I’ve just checked online. Forgive me, but the detail is important here. Assuming that interest rates NEVER GO UP in 25 years, which would be rash assumption, my loan repayment on that £240,000 would be, I am told by the calculator, £1107 – £1333 per month. Which doesn’t sound so bad does it (except it’s basically the rent on my nice flat in Queen Square); but if for a minute you indulge me, and times those numbers by 12 (months) and then by 25 (years), you will see that the cost of that loan is actually £332,000 to £399,000.

Now, if you were to be so rash as to tap in an interest rate of 7% (which is historically the base-line average interest rate for mortgages over long periods of time) that monthly payment jumps to £1696 per month, which is staggering £508,000 over the lifetime of the loan.

So your Studio flat in Zone 3, at the end of the day, better be worth £500,000 because that’s actually what you’ve paid for it.

You get my drift? Oh, and please don’t forget the original £60K that you’ve got to pop in in the first place.

So fourth, and that brings me to a more fundamental problem, I’ve never just had a deposit given to me by anyone else. Almost every single person I know of my age who owns a house had their mortgage deposit paid by their parents, or their granny. Good fortune, for sure, and I don’t resent it one bit. My Mum & Dad are the rock of my life, and they’re incredibly generous, but I’m not about to shake out their pockets for a 20% deposit for a flat in London, am I?

Fifth, I’ve never ever been able in my whole life to be able to afford to buy anywhere I ever wanted to live. I admit it. I hate commuting, I’ve always liked being able to walk to work. (Sometimes people ask me in incredulity ‘Ben how do you manage to get so much stuff done?’. Do you know the answer? In the last 10 years, I’ve had a 4 minute walk to work. That’s an AWFUL lot of time saved).

So I’ve never been able to afford to buy any place I could walk to work from. But I can afford to rent them. In fact, not just one – but two!

I cannot tell you how much I love my house in Dorset and my flat in London. But let me be entirely honest. Both of these houses would be very very very expensive to buy. A staggeringly eye-wateringly large amount. The sort of amount that you could only just about cover if you happened to be… I suspect… a banker, or a lawyer. Neither of which I would be very good at, I am sure you will agree.

The funny thing is, in both cases, I have a very good long-term landlord who is principally interested in securing good long-term tenants who pay their rent and look after the building. They’re not interested in making a quick buck. And because in both cases they’ve owned the building I live in for hundreds of years, there is no mortgage to pay, no ‘buy-to-let’ investment to cover. My rent is the return. There’s no need to squeeze a profit on top.

The second nice thing about this is that both landlords were very happy when I asked for long leases. We’ve all got security that way. I know that I’m not going to be given my notice in 6 months time, and therefore I don’t mind doing the flat and the parsonage up. I don’t mind spending money on the garden or the decoration, because I know that I’m going to live there for a long time.

Now a lot of people say to me at this point: “but you’re just throwing your money away doing up someone else’s house”. At this point I look at them curiously, at their expensive jeans or expensive haircut or think about the expensive i-pad they bought that is instantly redundant or think of their last expensive holiday abroad.

Nothing wrong with any of those things, I’m all in favour of all of them, believe me; but I’ve never understood why going out to an expensive restaurant is not a waste of money and as soon as I spend a bean putting a nice doorknob or fireplace into someone else’s property; well – I must be certifiable! Lock me up! Put me away!

And to which, I merely reply, I’m not spending it on the house. I’m spending it on my life. I’m buying a nice door handle or tap or fireplace because it is something I use and look at and enjoy every single day of my life. And divided by a ten year tenancy, which is, let’s face it, 3650 days, my beautiful marble fireplace at the Parsonage costs about 35 pence a day, which is about the cheapest pleasure I have, believe me. AND I can leave it there for the next people to enjoy. It’s permanent, not transient, like so many pleasures in life.

What I really love in my flat is that if something goes wrong it’s not my problem. The boiler blows up? The landlord has to fix it. The roof starts leaking? A quick call and that’s the end of the matter as far as I am concerned. I get to spend money on all the nice stuff, not the boring bits of owning a house.

I was once on a car journey with my friend George Saumarez-Smith. One of the games to while away the hours was to speculate what single word could be used to sum up the others’ life. Mine for George was Measurement, and for those of you who know George that’s quite a good word. His for me was Improvement, which I think is probably about right. And what’s fascinating to me is that rather often people will only look to improve things they own. Sure, I’d like to have an investment in whatever I’m working on. I like thinking for the long term, and I like stability. But I don’t actually have to own something in order to have to look after it.

The flip side of owning something is that it often makes you go much more mad in terms of throwing money away. You spend absurd amounts of money on something in the thought that ‘its an investment‘. Kitchens and bathrooms are the usual case in point. I’ve got to be bitterly honest, most £60,000 kitchens end up in the next owners’ skip before 500 hot dinners have been cooked in them. Whereas conversely, when I did up my kitchen in Dorset, I think I spent about £1000 on fixtures and fittings, and it’s about the nicest room I know. There’s a reality check involved in being a tenant. You will spend just enough to make something nice enough to live with for 10 years. But you never go mad. So who is really wasting the money guys?

Okay, before this gets boring, I would finally like to check that all the mortgage payers of life have a proper pension plan in place? I very often hear at the same dinner party where my neighbour is scandalised that I don’t own a house the following phrase: ‘my home is, after all, my pension’.

Well that’s just great. As soon as you retire and stop working the one thing you have to do is move down a size or three, ‘downsizing’, as it’s euphemistically called, or move to somewhere you don’t really want to live but pretend it’s rural retirement bliss, and release all of that expensive equity to produce something to live on.

For me, when I grow old? I want to live right in a tiny rental flat (where it’s someone else’s problem to deal with the boiler) in the centre of London, where I can zoom around on public transport or in endless taxis to all the pleasures of life in old age, theatres, exhibitions, cinema, taking my godchildren and hopefully a few handsome young gay admirers out to expensive dinners and generally having fun. I’ve never understood why people want to retire to the country. I want to live in the country my whole life and retire to the city centre.

And so do remember that in order to get a reasonable pension, they say you should be saving about a quarter of your annual salary. Are you?

Mortgages are not saving. They are debts. You are borrowing a massive amount of money for a very long period of time and paying a lot of interest to do so. That’s fine if you have to. But don’t forget that you’ve got to live and eat and enjoy life once you stop working and that’s not the same thing as owning a house where you can’t afford the heating – which is a problem that is facing many pensioners. (Be a little scared, too, that if you own a house these days, the Government might make you sell it in order to pay your medical bills, but that’s another whole story).

Well, I’ve got a few things off my chest there. You can tell my cold is better can’t you?

So, to end, here’s why I am now wanting to buy a house. Because unless you do, as far as your bank, or in fact any other business lender, is concerned: you don’t exist. And that’s not a great feeling. I remembered it wasn’t so long ago that unless you owned a house, you couldn’t vote. So watch this space. Maybe I’m about to start house-hunting.